What To Expect From Bitcoin Price In November 2025

Bitcoin (BTC) has faced difficulty regaining momentum in recent days, with prices struggling to break above the $115,000 resistance zone.

Despite this short-term weakness, strong bullish indicators are emerging, suggesting that November could favor upward movement.

Sponsored

Bitcoin Has A History

November has traditionally been one of Bitcoin’s strongest months. Historical data reveal that Bitcoin’s median return in November stands at 11.2%, making it the second-best performing month after October. This consistent pattern of gains tends to boost investor optimism and strengthen market participation at the beginning of the month.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

However, speaking exclusively to BeInCrypto, Rachel Lin, Co-Founder and CEO of SynFutures, highlighted that November 2025 could be different.

“Global trade tensions, inflation, and recession fears have weighed heavily on all risk assets, and Bitcoin hasn’t been spared. We’ve seen it trade in that $104,000 to $108,000 range recently. Looking ahead, I think November will likely bring consolidation or a modest recovery — not a full-on rally unless a strong catalyst appears. If trade tensions worsen, Bitcoin could retest the $90,000 area. But if support holds above $110,000, we could easily see a 10 to 20% rebound toward $120,000 to $140,000 by the end of the month, especially with ETF inflows holding up and whales quietly accumulating,” stated Lin.

Sponsored

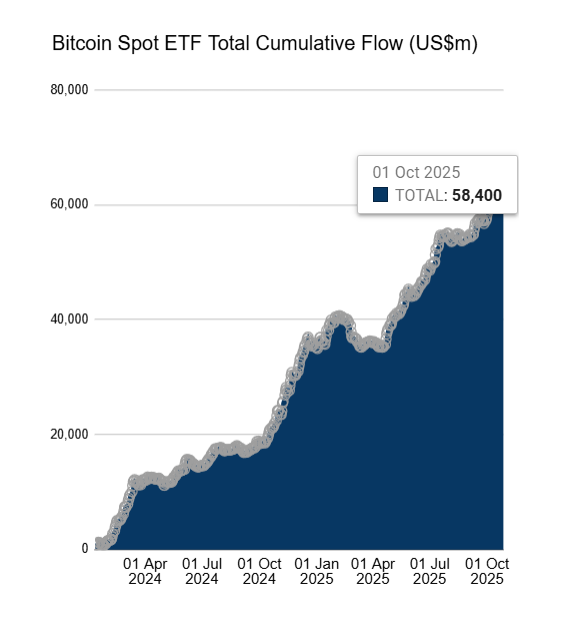

Nevertheless, a sign of strength lies in the performance of Bitcoin spot exchange-traded funds (ETFs). In October alone, Bitcoin ETFs recorded net inflows totaling $3.69 billion. The month began with cumulative flows at $58.4 billion and closed at $62.1 billion, reflecting a substantial increase in investor exposure to BTC through regulated investment products.

These inflows demonstrate that institutional investors continue to see Bitcoin as a valuable asset in diversified portfolios. Lin also noted that even after some mid-month outflows, the overall trend is clearly positive.

“On October 21 alone, we saw nearly half a billion dollars in new inflows led by BlackRock and Fidelity. That shows just how strong conviction still is. Institutions increasingly see Bitcoin as “digital gold,” a hedge against inflation, debasement, and global uncertainty… What’s also interesting is how this behavior mirrors onchain activity. Every time we get a correction, inflows resume quickly, whales accumulate, and ETFs end up holding an even larger share of the total Bitcoin supply, now over 6%. With regulation improving and fees dropping, it’s become easier and cheaper than ever for traditional investors to get exposure,” Lin told BeInCrypto.

Sponsored

Bitcoin Is Establishing Crucial Levels

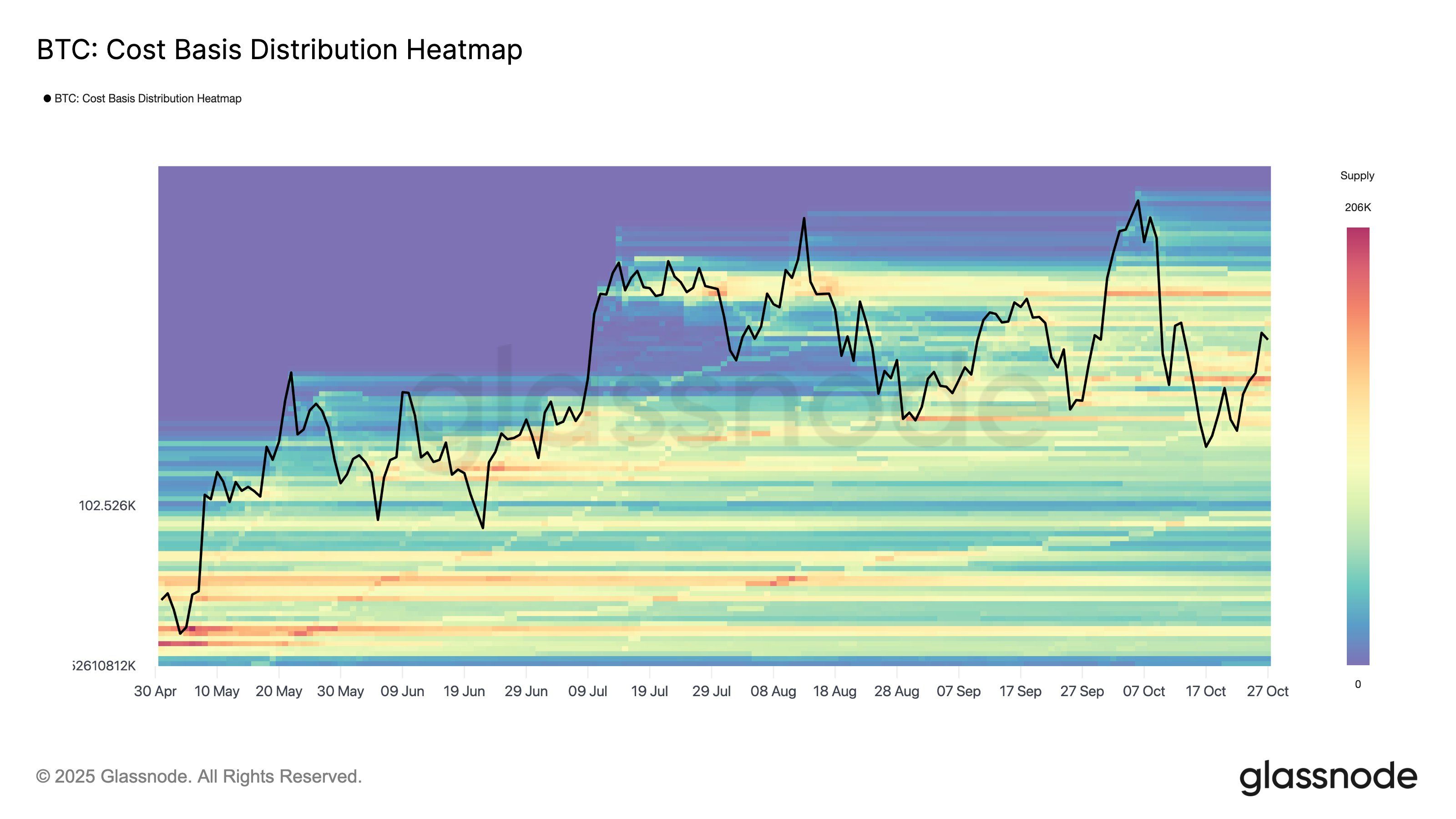

On-chain data adds another layer of insight into Bitcoin’s current position. The Cost Basis Distribution Heatmap highlights significant support of around $111,000 and notable supply pressure of nearly $117,000. This range defines the battleground between recent buyers looking to defend positions and profit-takers seeking exits after the recent rally.

A breakout in either direction could determine the trajectory for the coming weeks. If bulls manage to push beyond the $117,000 supply zone, momentum could accelerate sharply. Conversely, a failure to hold $111,000 could shift sentiment bearish, prompting short-term corrections.

Sponsored

BTC Price Awaits Breakout

At the time of writing, Bitcoin trades at $114,518, sitting just below the key $115,000 resistance level. With investor sentiment turning increasingly positive, BTC could soon push through this barrier. A confirmed breakout would likely trigger renewed momentum, driving Bitcoin price toward higher resistance levels in November.

Bitcoin’s near-term target remains its all-time high (ATH) of $126,199, which requires a 10.2% rise from current levels. To achieve this, BTC must first clear strong resistance zones at $117,261 and $120,000, where heavy supply from profit-takers could temporarily slow progress.

However, if Bitcoin fails to sustain momentum above $115,000, short-term weakness could reemerge. A dip toward $110,000 remains possible if buyers lose conviction. Any move below this support would invalidate the bullish outlook.