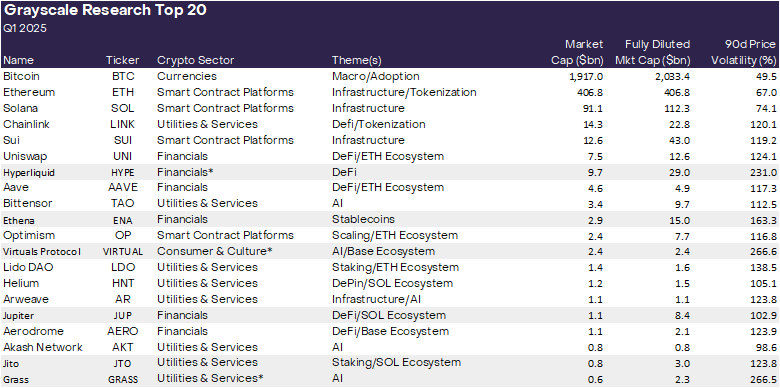

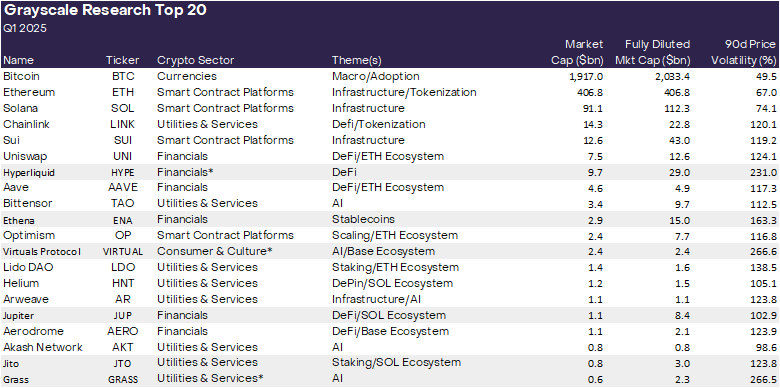

Grayscale lists HYPE, VIRTUAL, ENA, JUP among high potential tokens for Q1 2025

Key Takeaways

Grayscale Research has added Hyperliquid, Ethena, Virtual Protocol, Jupiter, Jito, and Grass to its top 20 crypto assets for Q1 2025.

The firm’s list reflects a focus on decentralized AI technologies and Solana ecosystem growth.

Share this article

As 2024 draws to a close, Grayscale Research has published its updated list of the top 20 crypto assets expected to perform well in the upcoming quarter. The list features six new altcoins, including Hyperliquid (HYPE), Ethena (ENA), Virtual Protocol (VIRTUAL), Jupiter (JUP), Jito (JTO), and Grass (GRASS).

Grayscale Research notes that these updates are influenced by themes surrounding the implications of the US elections, advancements in decentralized AI technologies, and growth within the Solana ecosystem. The team forecasts these will be key themes for Q1 2025.

Decentralized AI platforms were previously included on Grayscale’s Q4 2024 list, featuring Bittensor (TAO). For the next quarter, there is a heightened emphasis on this sector with the inclusion of VIRTUAL and GRASS.

Launched in October 2024 on Base, Virtuals Protocol allows users to create, deploy, and monetize AI agents without requiring technical expertise. The VIRTUAL token hit $1.4 billion in market value within one month of launch. At press time, it is the largest AI agent coin with a market cap of $3.4 billion, according to CoinGecko data.

Tapping into both the growing AI and Solana ecosystems, Grass is a decentralized network built on Solana’s layer 2. It allows residential users to contribute their unused internet bandwidth through nodes, which collect public web data for AI training. The GRASS token has soared around 160% since its launch in late October, per CoinGecko.

Meanwhile, Hyperliquid has emerged as a leader in trading volume and total value locked among decentralized perpetual swap platforms. Its HYPE token has risen approximately 300% since its November 29 launch, reaching $28.

Jupiter leads as the primary DEX aggregator on Solana with the highest total value locked, while Jito, a liquid staking protocol, generated over $550 million in fee revenue in 2024, Grayscale Research highlights.

Alongside the new additions, six assets—Toncoin (TON), Near (NEAR), Stacks (STX), Maker (MKR), Celo (CELO), and UMA Protocol (UMA)—were removed from the list.

According to Grayscale Research, these projects remain relevant to the crypto ecosystem, but the team believes the revised selection offers a more compelling risk-adjusted return profile for the next quarter.

The smart contract arena

A key observation from Grayscale Research is the growing competition in the smart contract platform segment. Although Ethereum had some big wins in the fourth quarter, it faced increasingly competitive pressure from other blockchains, especially Solana.

Moreover, investors have started looking at other alternatives to Ethereum, like Sui and TON. These platforms, according to Grayscale Research, have different approaches to the “blockchain trilemma.”

The team reiterates that fee revenue will be a key driver of value for smart contract platform tokens. They suggest that a platform’s ability to generate fees is directly related to its market capitalization and its ability to reward token holders through mechanisms like token burning or staking.

“The greater the ability of a network to generate fee revenue, the greater the network’s ability to pass on value to the network in the form of token burn or staking rewards. This quarter, the Grayscale Research Top 20 features the following smart contract platforms: ETH, SOL, SUI, and OP,” the report wrote.

Share this article